The US Dollar aimed higher against its major counterparts this past week, fulfilling a move that markets had been building up since the beginning of August. Throughout June and July, the markets priced in a pivot narrative for the Federal Reserve despite the highest inflation in 40 years and the most aggressive tightening in decades.

The US nonfarm payrolls report will take center stage next week as speculation about the size of the Fed’s next rate hike goes into overdrive. Investors will also be keeping a close eye on the latest inflation readings in the euro area ahead of the September rate decision amid growing gloom about the bloc’s economic outlook. PMI indicators out of China and as well as quarterly data from Australia and Canada will be important too in helping to gauge the health of the big economies.

Three high-frequency economic prints next week will likely move the markets whether they meet expectations or not: China’s PMI, the eurozone’s CPI, and the US employment report.

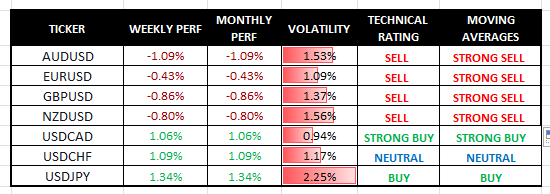

Major Currencies Performance and Signals

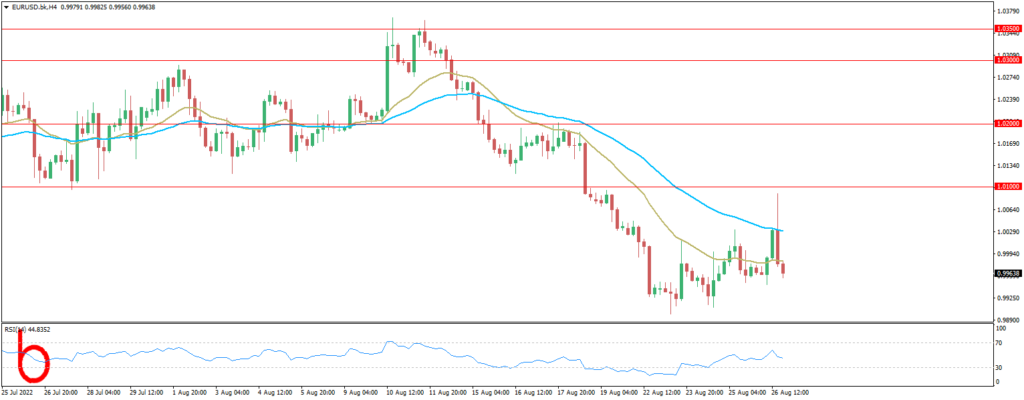

EUR/USD

The EUR/USD currency pair went back and forth last week as we continue to see a significant amount of noisy behaviour between the 1.00 level, and the 1.01 level. On the pair we are Bearish this week.

FORECAST: SELL

Resistance: 1.0200, 1.0250, 1.0300

Support: 1.0150, 1.0100, 1.0050

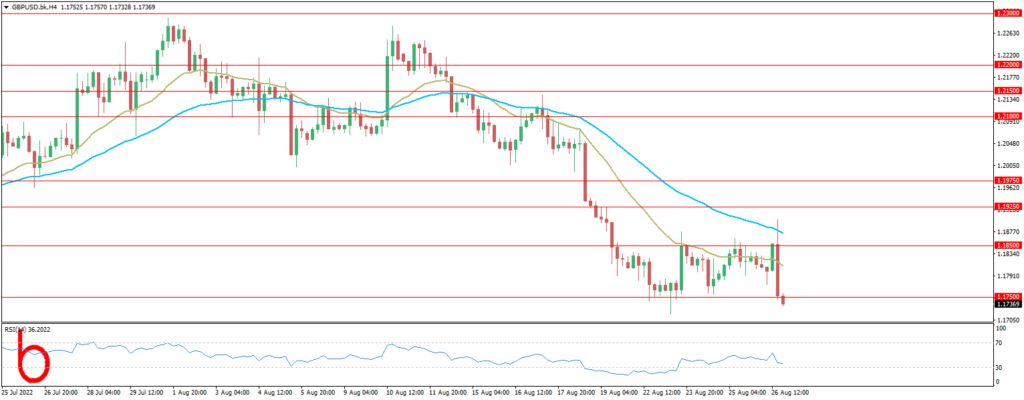

GBP/USD

The GBP/USD currency pair initially rallied during the trading week but gave bank gains as we slammed into the 1.20 level. We remain bearish on the pair.

FORECAST: SELL

Resistance: 1.2100, 1.2150, 1.2200

Support: 1.2050, 1.2000, 1.1950

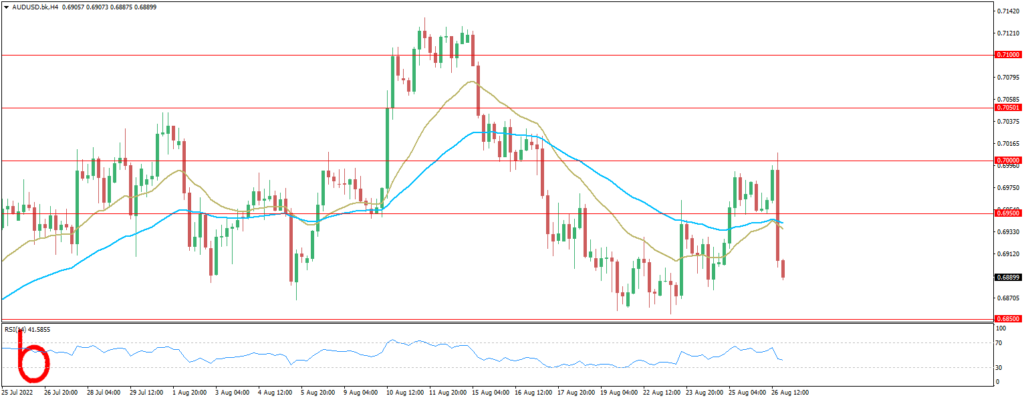

AUD/USD

The AUDUSD pair edged higher to 0.7045 last week but retreated since then. Initial bias is neutral this week first. On the downside, break of 0.6858 minor support will argue that the rebound is over. We remain bearish on the pair.

FORECAST: SELL

Resistance: 0.6950, 0.7000, 0.7050

Support: 0.6900, 0.6850, 0.6800

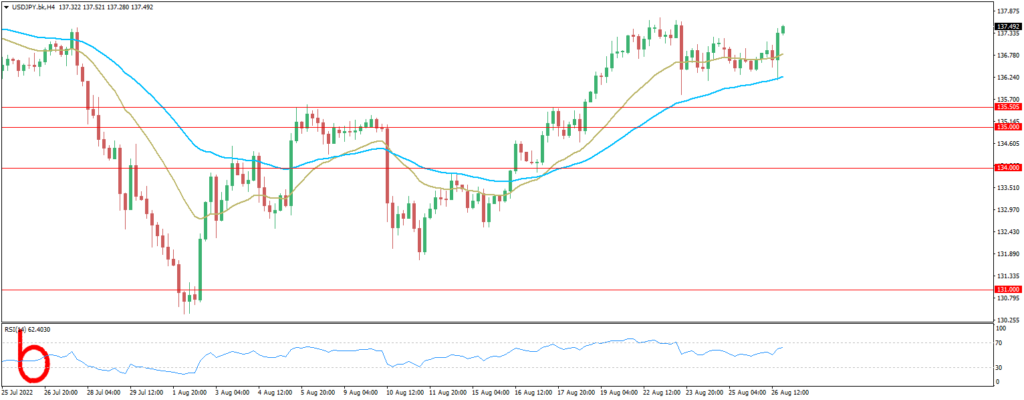

USD/JPY

The USDJPY pair fell initially during the trading week but then turned around near the ¥1.31 level to show signs of life. We are bullish on the USDJPY pair.

FORECAST: BUY

Resistance: 135.00, 134.00, 134.50,

Support: 133.00, 132.50, 132.00

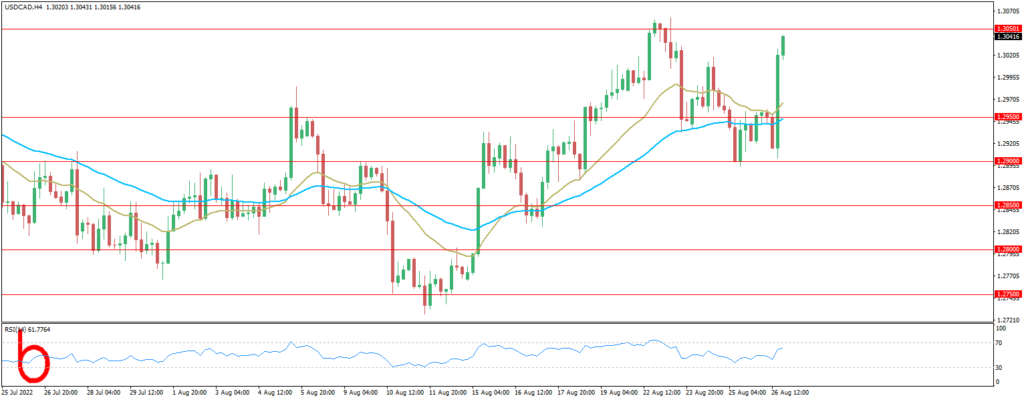

USD/CAD

The pair closed the week higher as the dollar strengthened and the Loonie weakened. Our weekly USDCAD forecast is bullish as the upbeat US jobs report gives the Federal Reserve room to be more aggressive.

FORECAST: SELL

Resistance: 1.2950, 1.3000, 1.3050

Support: 1.2900 1.2850, 1.2800

Warning:

Trading on CFDs involves a high level of risk, including full loss of your trading funds. Before proceeding to trade, you must understand all risks involved and acknowledge your trading limits, bearing in mind the level of awareness in the financial markets, trading experience, economic capabilities and other aspects.

Disclaimer:

Market Trends, Charts, Trading Ideas or other information provided by BKFX LLC and/or third parties are not intended as an investment advice and/or recommendation. The information provided is not presented as suitable or based on your specific need. You are responsible for your own investment decisions and you should not trade with money you cannot afford to lose. Any views or opinions presented in this Article are solely those of the author and do not necessarily represent those of the Company, unless otherwise specifically stated. The Company may provide the general commentary which is not intended as an investment advice and must not be construed as such. Seek advice from a separate financial advisor if an investment advice is needed. The Company assumes no liability for errors, inaccuracies or omissions, inaccuracies or incompleteness of information, texts, graphics, links or other items contained within this article/material.