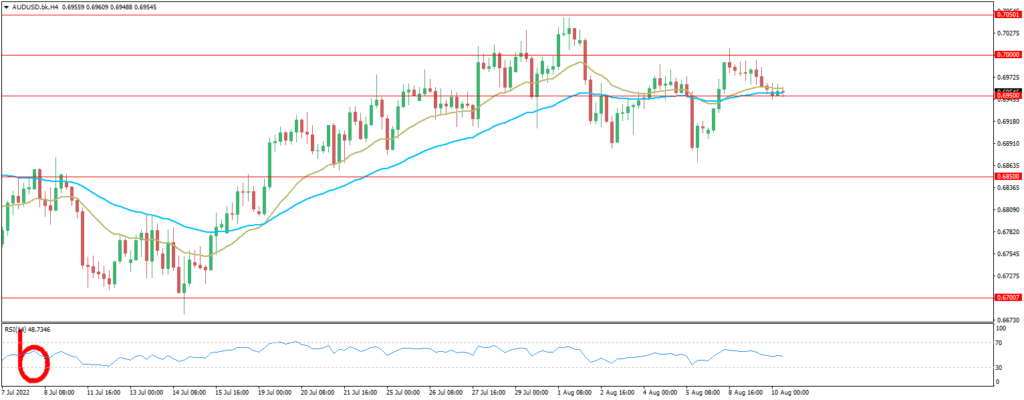

Aussie holds lower ground near 0.6960 during Wednesday’s Asian session, defending the downbeat inflation data from China. In addition to China CPI and PPI data, careful attitude ahead of the US inflation numbers and fears of economic recession also weigh on the Aussie pair.

China’s headline Consumer Price Index (CPI) eases to 2.7% YoY in July versus 2.9% expected and 2.5% prior. Further, the Producer Price Index (PPI) dropped to 4.2% compared to 8.0% market forecasts and 6.1% previous readings.

Wall Street’s slow performance, as well as a rebound in the US 10-year Treasury yields to 2.79%, reveals a bitter sentiment in the markets. Additionally, the S&P 500 Futures also print mild losses at around 4,120 by the press time and teases the AUD/USD bears, due to the pair’s risk barometer status.

Moving on, Aussie investors may observe a slow session ahead of the US CPI, expected to ease to 8.7% from 9.1% on YoY. However, risk catalysts may entertain the pair traders. Also, important to watch will be the CPI ex Food & Energy which is likely to rise from 5.9% to 6.1%.

Warning:

Trading on CFDs involves a high level of risk, including full loss of your trading funds. Before proceeding to trade, you must understand all risks involved and acknowledge your trading limits, bearing in mind the level of awareness in the financial markets, trading experience, economic capabilities and other aspects.

Disclaimer:

Market Trends, Charts, Trading Ideas or other information provided by BKFX LLC and/or third parties are not intended as an investment advice and/or recommendation. The information provided is not presented as suitable or based on your specific need. You are responsible for your own investment decisions and you should not trade with money you cannot afford to lose. Any views or opinions presented in this Article are solely those of the author and do not necessarily represent those of the Company, unless otherwise specifically stated. The Company may provide the general commentary which is not intended as an investment advice and must not be construed as such. Seek advice from a separate financial advisor if an investment advice is needed. The Company assumes no liability for errors, inaccuracies or omissions, inaccuracies or incompleteness of information, texts, graphics, links or other items contained within this article/material.