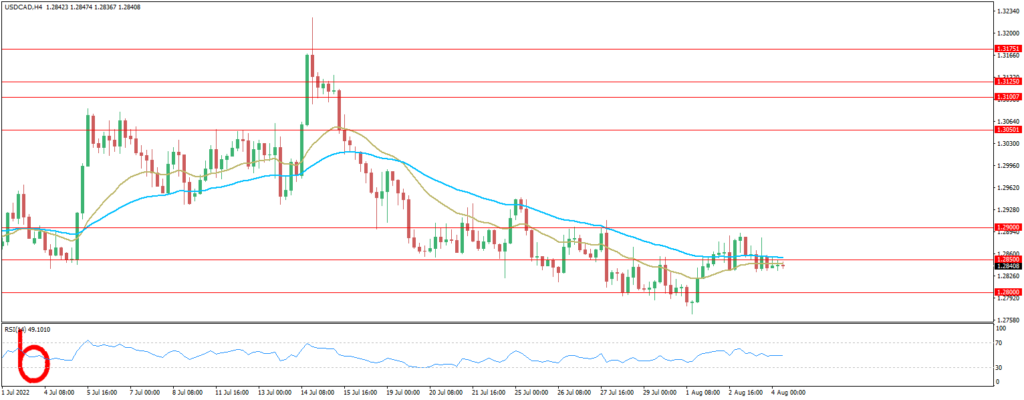

The Canadian dollar mostly ignored yesterday’s China/Taiwan tensions, and US Treasury yield moves with USDCAD adrift in a 1.2833-1.2890 band since yesterday. The Canadian dollar remains to be boosted by the Bank of Canada’s (BoC) aggressive inflation fighting posture, alongside relatively high oil prices.

The BoC raised interest rates by 100 basis points on July 13, which surprised the market. It shouldn’t have. Governor Tiff Macklem and the Governing Council misread the inflation outlook since prices started to rise a year ago. They were happy to appoint the US Federal Reserve view that inflation was transitory.

They changed their pitch after inflation remained persistently above target and showed no signs of being transitory. They hiked rates by 0.50% in March, April, and June, but inflation continued to rise. They hiked 100 bps on July 13 and left the door wide open to a similar move in September.

The BoC agreed that Canada’s inflation problem was due to a lot of external factors, including the war in Ukraine and the lingering impact of supply chain disruptions from the pandemic. The BoC also believes they can plan a “soft landing” because of the job market’s strength.

Warning:

Trading on CFDs involves a high level of risk, including full loss of your trading funds. Before proceeding to trade, you must understand all risks involved and acknowledge your trading limits, bearing in mind the level of awareness in the financial markets, trading experience, economic capabilities and other aspects.

Disclaimer:

Market Trends, Charts, Trading Ideas or other information provided by BKFX LLC and/or third parties are not intended as an investment advice and/or recommendation. The information provided is not presented as suitable or based on your specific need. You are responsible for your own investment decisions and you should not trade with money you cannot afford to lose. Any views or opinions presented in this Article are solely those of the author and do not necessarily represent those of the Company, unless otherwise specifically stated. The Company may provide the general commentary which is not intended as an investment advice and must not be construed as such. Seek advice from a separate financial advisor if an investment advice is needed. The Company assumes no liability for errors, inaccuracies or omissions, inaccuracies or incompleteness of information, texts, graphics, links or other items contained within this article/material.