The Reserve Bank of Australia increased the key interest rate by 50 basis points. The advice offered by the central bank was seen as “dovish” and drove the Aussie to the downside. The AUD/USD pair fell to 0.6910. After reaching a fresh daily high at 0.6909, it started to recover.

Since the beginning of the American session, it recovered more than 50 pips. At the same time, the AUDNZD that bottomed at 1.1007, the lowest in two weeks, rebounded and as of writing, it trades at 1.1055/60. The push to the upside took place as equity prices in Wall Street turned positive and as the US dollar lost momentum against commodity currencies, even amid higher US yields.

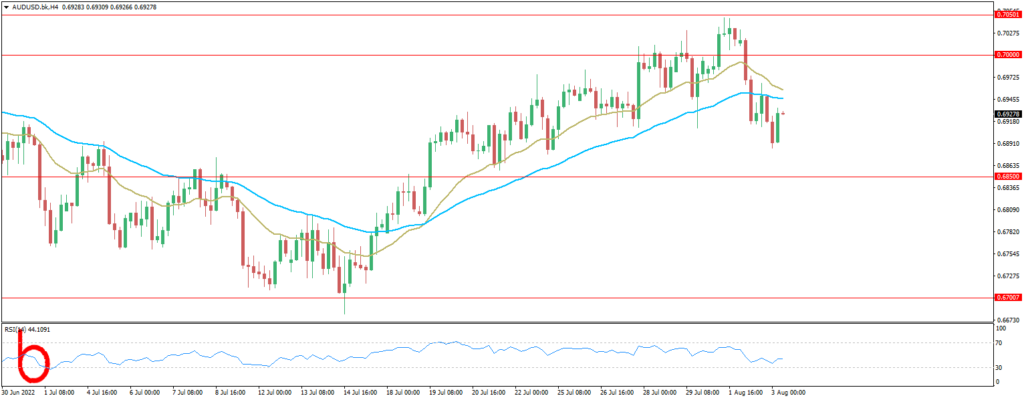

The AUDUSD pair chart shows the pair still moving sideways around 0.6970. The 0.6910 zone has become a critical support that if broken should clear the way to more losses, targeting first the 20-day Simple Moving Average at 0.6878.

Analysts at Rabobank, see scope for another bout of broad-based USD strength to push AUD/USD lower on a 1 to 3 month view but then they see a recovery. “We expect AUD/USD to rise to the 0.74 area on a 12 month view.”

Warning:

Trading on CFDs involves a high level of risk, including full loss of your trading funds. Before proceeding to trade, you must understand all risks involved and acknowledge your trading limits, bearing in mind the level of awareness in the financial markets, trading experience, economic capabilities and other aspects.

Disclaimer:

Market Trends, Charts, Trading Ideas or other information provided by BKFX LLC and/or third parties are not intended as an investment advice and/or recommendation. The information provided is not presented as suitable or based on your specific need. You are responsible for your own investment decisions and you should not trade with money you cannot afford to lose. Any views or opinions presented in this Article are solely those of the author and do not necessarily represent those of the Company, unless otherwise specifically stated. The Company may provide the general commentary which is not intended as an investment advice and must not be construed as such. Seek advice from a separate financial advisor if an investment advice is needed. The Company assumes no liability for errors, inaccuracies or omissions, inaccuracies or incompleteness of information, texts, graphics, links or other items contained within this article/material.