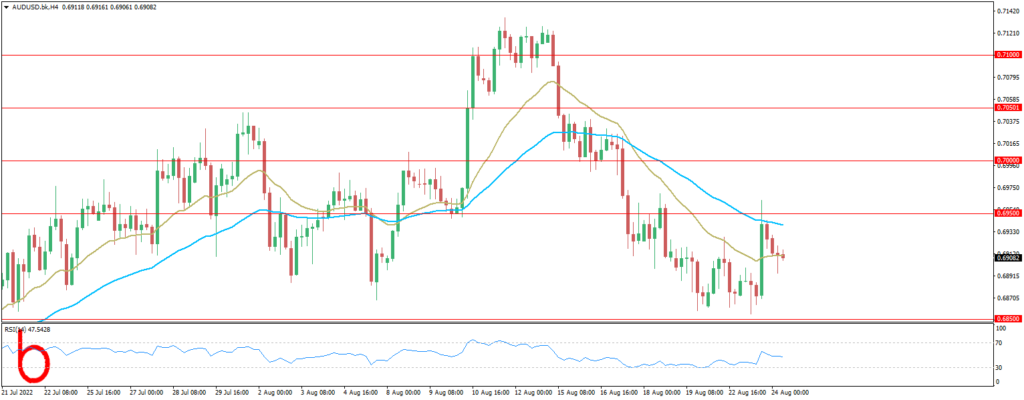

The Aussie appeared to be emulating the price action from June and the exchange rate may continue to track the negative slope in the moving average as the Federal Reserve prepares US households and businesses for a restrictive policy.

Though, new data announcements coming out of the US may prop up AUD/USD as the core PCE index, the Federal Reserve’s preferred gauge for inflation, is expected to narrow to 4.7% in July from 4.8% per annum the month prior, and signs of easing price pressures may encourage the Federal Open Market Committee (FOMC) to adjust its approach in combating inflation in an effort to foster a soft landing for the economy.

As a result, speculation for smaller Fed rate hikes may produce headwinds for the Greenback as the central bank acknowledges that “it likely would become appropriate at some point to slow the pace of policy rate increases,” and it remains to be seen if the FOMC will adjust the forward guidance at the next interest rate decision on September 21 as Chairman Jerome Powell and Co. are slated to update the Summary of Economic Projections (SEP).

Until then, the Aussie may stage a larger rebound as evidence of slowing inflation curbs bets for another 75bp Fed rate hike, but the recent flip in retail sentiment looks poised to persist as the exchange rate fails to defend the opening range for August.

Warning:

Trading on CFDs involves a high level of risk, including full loss of your trading funds. Before proceeding to trade, you must understand all risks involved and acknowledge your trading limits, bearing in mind the level of awareness in the financial markets, trading experience, economic capabilities and other aspects.

Disclaimer:

Market Trends, Charts, Trading Ideas or other information provided by BKFX LLC and/or third parties are not intended as an investment advice and/or recommendation. The information provided is not presented as suitable or based on your specific need. You are responsible for your own investment decisions and you should not trade with money you cannot afford to lose. Any views or opinions presented in this Article are solely those of the author and do not necessarily represent those of the Company, unless otherwise specifically stated. The Company may provide the general commentary which is not intended as an investment advice and must not be construed as such. Seek advice from a separate financial advisor if an investment advice is needed. The Company assumes no liability for errors, inaccuracies or omissions, inaccuracies or incompleteness of information, texts, graphics, links or other items contained within this article/material.